Our online life insurance policies

At over80life, we work with the best in the business to find you a life insurance policy to meet your needs. Explore this page to learn about the online life insurance products we offer.

Term life insurance

With multiple term lengths and a wide range of coverage amounts to choose from, you can select a life insurance policy that works best for you. Every term life insurance policy we offer includes level monthly premiums that never increase over the course of the policy. Product type, benefit amounts, and eligibility may vary by carrier.

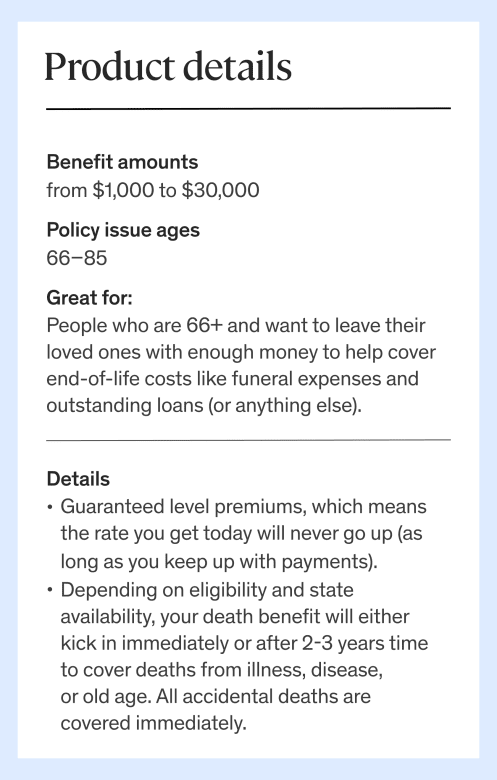

Whole life insurance

Age and health issues make it difficult for some to gain access to life insurance. That's why over80life offers whole life insurance. It helps your loved ones cover expenses such as funeral costs, outstanding debt, and other day-to-day costs. If you're aged 66 to 85, you can get approved in minutes without a medical exam, regardless of your medical history. Simply answer a few health questions. With a secure rate that never increases, you're covered for life.

How over80life works

over80life partners with some of the world's largest and most respected life insurance companies. You'll receive the dependability of centuries-old industry giants combined with the convenience of a modern technology company. With over80life, the online life insurance application process is entirely digitized to give you results in minutes. Once you apply, we analyze your information in real-time against our products to match you with the best policy and price available. We make understanding and investing in life insurance easy. If you have questions, our team of licensed agents is always here to help.

Why choose Over 80 Life

Fast, easy application

Our application process is simple, straightforward, and entirely online. That means you can apply for life insurance from the comfort of home—or anywhere. Most applicants don't even require a medical exam.

Money-back guarantee

If you're not happy with your policy for any reason in the first 30 days, we'll refund your payment in full. You're also free to cancel your policy at any time with no cancellation fees.

Lifetime customer support

Whether you need technical support, answers to your life insurance questions, or unbiased advice from a licensed agent, our team is ready to help.

A+ Rated

- Rated A+ by the Better Business Bureau

- Received an "Excellent" rating from Trustpilot as well as 4.8/5 stars for customer reviews.

- 4.7/5 stars on Google based on average customer reviews.